The Power of Partnerships and Enact’s Partner Ecosystem

1. The Power of Partnerships in the Solar & Battery Storage industry

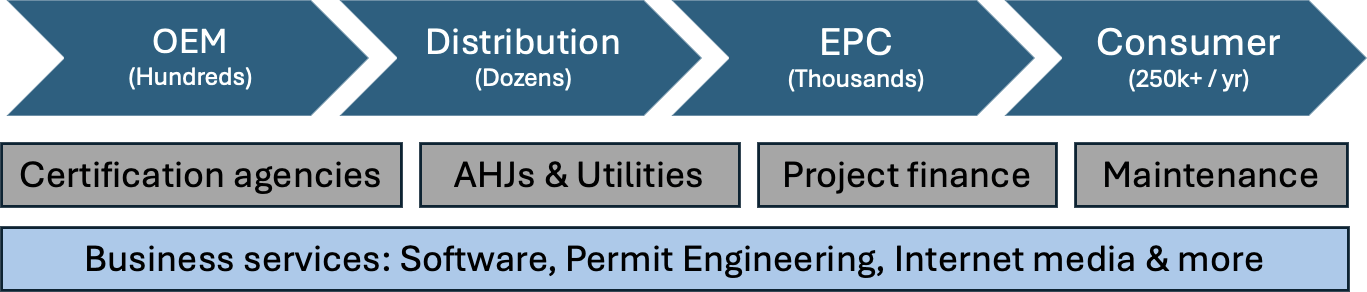

The business of deploying Solar & Storage projects for homes and buildings has a complex value chain that starts with OEMs and their distribution networks, followed by solar installation companies (also known as ‘EPC’ firms: engineering, procurement and construction), third-party financing firms and asset management.

As shown below, this value chain is fragmented with thousands of firms that work together to deliver ~300-500k residential projects per year and ~10k commercial projects per year in the US market. Also shown below is the consumer’s extended influencer and marketing network that plays a significant role in their buying decision; plus the authorities that grant approval for such projects – cities, AHJs & utilities that provide net metering access. And finally, various other providers of business services like software, third-party marketing and legal services play a major role as well.

Behind every successfully completed project, there are ~20 different companies involved : 10+ different manufacturers of various components, at least one distributor for key hardware supply, 3-5 different firms that complete the EPC role (including permit engineering, outsourced labor crews and third-party marketing firms), at least one consumer financing company (80% of projects are financed), at least 2 authorities granting approval along with one maintenance provider and one or more software vendors.

Needless to say, it’s a complex industry like many others that delivers $Billions of dollars in product/services per year to building owners. Partnerships between firms happen at every step of the value chain: OEMs partner with distributors downstream, similarly distributors partner with EPCs downstream and EPCs in-turn partner with a host of business service providers like financing companies, permit engineering firms, marketing platforms and also maintenance providers.

Why are partnerships so crucial for success in this industry? There are four key reasons:

-

Reduce customer acquisition cost: partnerships along the value chain help every firm reduce its own customer acquisition cost. E.g. for an OEM, it is difficult to find and serve every EPC in every city / state on their own in a profitable way and so partnerships with regional distribution companies is crucial to gain EPC customer access.

Similarly, for an EPC, it’s crucial to partner with marketing platforms that help find end-clients through a variety of online marketing services, either online and offline. In the US market, soft costs reign high and project margins are slim, hence keeping customer acquisition cost low is crucial for success.

- Efficient Scale-up of operations: relying on out-sourced third-party firms for specific services like financing of projects, or even repair and maintenance helps build scale faster. While many firms often grow to internalize certain functions (e.g. EPC launching a fund in-house, or even developing in-house software tools), the most successful firms identify their core competence quickly and rely on the best partners to do the rest, for faster growth. The business rules around solar and storage permitting, financing and even utility pricing / incentives vary from one city/state to another – hence partnering with software platforms that can simplify design and sales of new projects can help EPCs grow faster.

- Improve business focus: for every firm in the value chain, it’s crucial to lock the core-competence internally. Whether it’s a financing firm or a maintenance provider, they must identify the one thing they are good at, and improve that over time with focus across the organization. Partnerships allow this to happen faster – firms that quickly find their core focus, and partner with others to achieve the rest of the integrated value offering downstream do better in the long run. It’s the classic ‘build vs buy’ choice, and the most successful firms find out quickly that the ROI is poor to ‘build’ everything in house.

-

Data-access for Reliable Asset Operations: partnerships across the value chain help improve the quality of data access for improved maintenance too. For example, a hardware OEM like a battery-inverter maker provides live data on its performance hourly / daily on open networks and this helps EPCs / maintenance firms react to issues quickly, which in turn helps reduce warranty costs and improves customer satisfaction.

Solar and storage assets provide long-term value by fixing the energy cost, and break-even over 3 to 7 years depending on the location, while operating for 25+ years of warranty. The industry is yet to mature and EPCs being fragmented often go-out of business. The customer’s Asset reliability is important: and having only ONE firm stand behind their system can be risky: unlike the car industry, where OEMs have reliable & powerful dealer networks whereby the customer can purchase and service their cars from one OEM / dealer, Solar / storage assets are equally expensive, yet there are no such OEM / dealer networks. Hence it’s crucial for consumers to have access to data for their project(s) at one place. Software platforms like Enact have the unique ability to enable such partnerships.

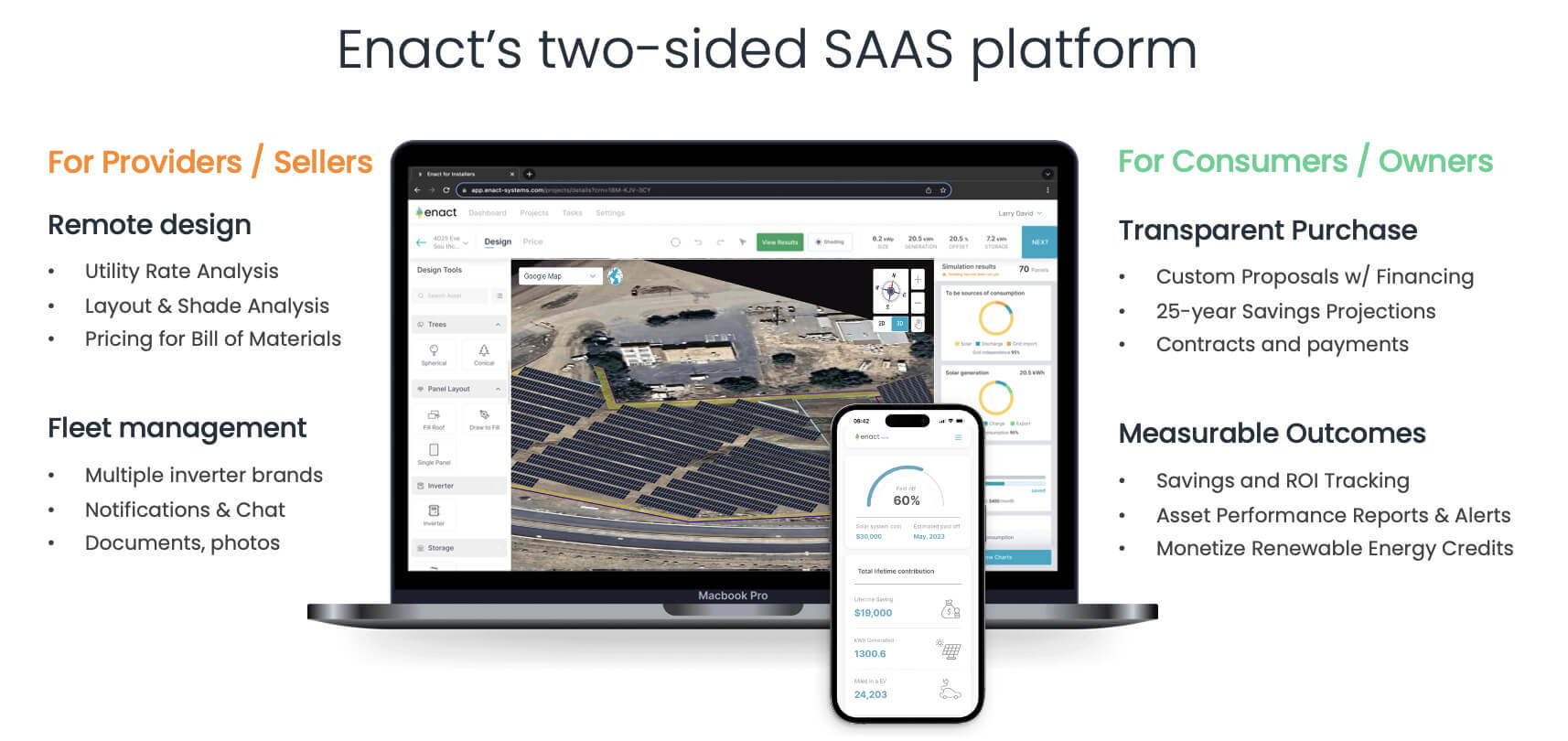

2. Enact Introduction: our unique, end-to-end software platform

Unlike other solar software competitors like Aurora or OpenSolar, Enact is highly differentiated with its focus on asset management & customer outcomes. Enact is the only platform today that has monetized the entire customer journey, with subscription revenues from BOTH the installer and the consumer (B2B2C). Enact’s commercial solar capabilities are now well established in many markets too, so this combination of features has enabled revenue growth in multiple countries simultaneously.

3. Enact’s Partner Ecosystem

Enact completed its 10th year of operations in 2024 and over the years, Enact has grown its business model carefully while leveraging partnerships consistently along the way. Enact first started with B2B software subscription revenues leveraging its design software platform. Later it unlocked B2B2C revenue through the launch of its Consumer Asset Management offering, and even direct-to-consumer design services / asset management revenues in California.

Powerful partnerships helped Enact scale its revenue lines rapidly, while keeping customer acquisition costs low and maintaining its core business focus on software and data services. Here’s some examples of successful partnerships, divided into three main groups, only focusing on the US market (additional partnerships are global)

- Partnerships to unlock access Installer clients for Software SubscriptionSuch firms have hundreds of Installer clients, so integrating with them and offering their products can provide automation and stickiness to the user.

- Financing providers e.g. Sungage and LightReach

- Permit Engineering firms e.g. ExactUS and CRENG

- Distributors e.g. CED Greentech

- Other Software platforms e.g. BluBanyon

- Other Hardware OEMs e.g. Renusol (roof structure)

- Partnerships that help improve end-customer asset managementEfficient asset management requires removal of ‘data silos’ and Enact’s integration with different OEM hardware data clouds like inverters and batteries enables centralized data access, that enables improved customer service and issue resolution

- Inverter Hardware OEMs for data access e.g. Solark and Fronius

- Installation partnerships (“Insider”) e.g. 20+ US EPCs

- Service and repair networks e.g. 5+ firms like JP Solar that fix / repair

- Corporate Partnerships that help reduce end-customer acquisition costEnact services end-consumer solar and storage project needs directly in California, partnerships with different corporates below enables lower cost of customer acquisition

- Retail networks e.g. Batteries Plus and Walmart

- Home Electrification partners e.g. Quit Carbon

- New-home aggregation e.g. Haven Development

In addition to the above categories, Enact’s Product Platform also has technology partnerships with dozens of vendors (e.g. data providers, imaging providers, cloud services). Enact also partners with a variety of businesses to scale its offering globally.

Explore the benefits of joining the Enact Partner Program and grow with us.

See how Enact’s software can help you win more projects and better serve your customers. Book a free demo with our team today.

Written by Deep Chakraborty, CEO of Enact Systems, Inc.