NOTE: This blog is not intended to offer financial advice but to inform consumers about the existence of financial options for solar energy. It is important for every consumer to examine their own financial reality and capabilities when it comes to financial decision making.

Solar panels are a great addition to your home or small business, but you may be worried about the cost. The average cost of a solar system for a typical home is around $16,000 in 2023, according to Forbes. The good news is that not only do solar panels pay for themselves in 4-12 years, but there are a variety of financing options and incentives available.

For many homeowners, a cash payment for a solar energy system is unrealistic. Financing options make solar more accessible to homeowners, with the two major types being solar loans and solar leases. Through Enact, both homeowners and businesses have access to virtually every financing option under the sun. Enact offers a variety of solar loans with a wide range of down payment options, annual percentage rates and timelines.

Cash payments and solar loans can be eligible for both federal and state incentives. Federal and state incentives make solar more affordable for both homes and businesses. Incentives come in a variety of policies, including tax credit deductions, rebates and net metering policies.

What financing options are available for solar panels?

An Enact advantage is we have partnered with financing providers that offer almost any financing option available to consumers. Consumers can finance through the Enact platform or pursue their own separate financing options. However you want to pay for clean energy, Enact can work with you. Here are a few of the most common ways to finance your solar project.

What financing options are available for solar panels?

An Enact advantage is we have partnered with financing providers that offer almost any financing option available to consumers. Consumers can finance through the Enact platform or pursue their own separate financing options. However you want to pay for clean energy, Enact can work with you. Here are a few of the most common ways to finance your solar project.

Cash

A cash purchase is a straightforward solar payment. Cash is a great way to maximize savings by avoiding interest payments and loan fees. Another benefit of paying in cash is that you don’t need a credit score to go solar. It is also the quickest way to own your own solar panel system. Cash payments are eligible for the federal solar tax credit. The incentive could mean you could get thousands of dollars back for your solar installation in the next the tax season.

The downside is that paying in cash upfront can drain your bank account or sometimes be impossible. Most people don’t have a lump sum of cash lying around to cover the entirety of solar panel equipment and installation. People with stable income and a large amount of savings could consider making a cash payment for solar.

Solar Loan

The most popular option is using a solar loan. Solar loans are a great financing option because they allow homeowners to go solar without a heavy initial cost. At the end of the agreement, homeowners can own their own solar set up. There are zero money down options and solar loans can cost less than your monthly utility bill. Enact offers a wide variety of solar loans through partners with multiple down option and APR options. Solar loans are eligible to receive rebates and tax credits for your solar system.

We offer an all-in-one digital service that assesses your home or business, creates a custom design and coordinates the entire process. And can help compare loan options in minutes for you, e.g different term / APR and fees etc, on the impact of long term savings over 25 years

Solar Lease & the Power Purchase Agreement

A solar lease or a power purchase agreement (PPA) allows homeowners to enjoy the benefits of going solar without owning the equipment. A third party owns the solar system on your roof and sells you the electricity at a predetermined rate. The benefits of a solar lease include no upfront costs and even better, no maintenance required on your end. All maintenance is the responsibility of the company who owns the solar system.

When using the lease, the home or business owner can no longer claim the federal income tax credit, as that is now claimed by the leasing company that owns the asset.

Enact allows detailed financial analysis of solar lease or PPA offers for commercial projects on its platform. The use of Solar lease or PPA for homeowners has declined in recent years (compared to loans). While it is possible for homeowners, it is usually more advantageous to purchase your home’s solar energy system through cash or loan financing.

What to expect from our financial proposals?

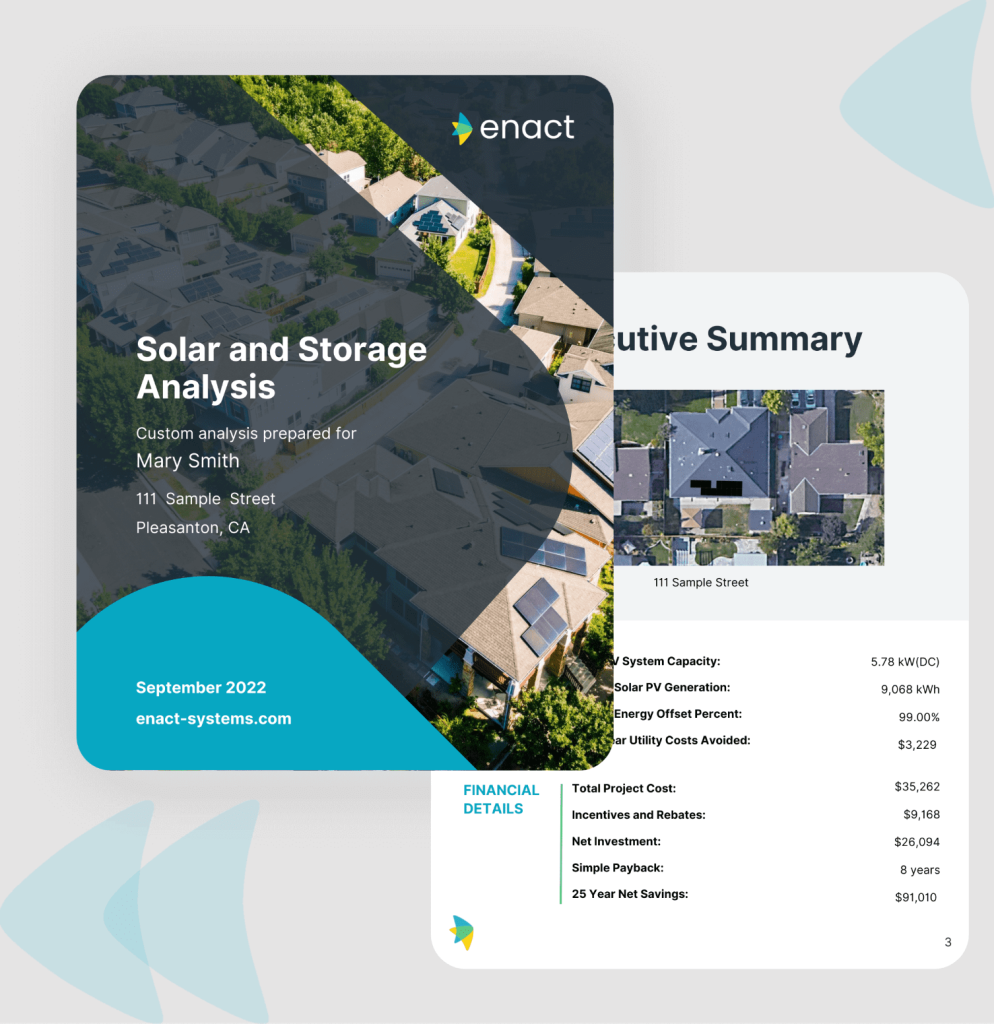

Our energy experts understand the world of solar can be confusing, but we will explain every step of the process and answer any questions. We offer transparent, comprehensive financial proposals that you can review before the process. Consumers have access to almost any type of financing tool available — and can use third-party finance options. We offer a variety of loans through our partners, with differing down payments, APR and timelines. Every financial proposal will include complete investment cash flow over the next 25 years and thorough savings calculations.

Our estimated costs are shown upfront without hidden fees — if something unexpected pops up that incurs new costs, you have the right to withdraw from the contract. Enact also offers options to combine solar costs with any home improvement costs needed for solar, such as a new roof. Financing through Enact’s platform is the most seamless and convenient option. If you decide to finance through Enact’s network of financing providers, there is usually no prepayment penalties so you can pay off your solar loan early if possible to avoid additional interest.

Other options outside Enact

Homeowners or business owners looking to use Enact to coordinate their solar installation process are able to seek outside financing tools. Possible options include refinancing your home, a home equity loan or a home equity line of credit (HELOC) arrangement with your bank. Regardless of which option you choose, Enact Systems’ energy advisors will work with you to power your home through solar.

What incentives are available for solar panels?

Solar panels are an investment, but there are government incentives that makes clean energy more available to consumers. Government incentives are offered across the federal, state and local levels.

The Federal Solar Tax Credit

The federal government offers a solar investment tax credit (ITC) for both residential properties and businesses, but this article will focus on residential solar tax incentives. The ITC was expanded under the Inflation Reduction Act of 2022 — which incentivized solar panels, solar batteries and electric vehicles for consumers. Homeowners who purchase a solar energy system may be eligible to deduct 30% of the installation cost. The 30% deduction will be available until 2033, when it will drop to 26% of installation costs. The ITC has no set cap on the cost of solar energy installations. The solar tax credit is a dollar-for-dollar reduction on the amount of income tax a homeowner would otherwise owe the Internal Revenue Service. A great resource to see if you qualify for the solar ITC is EnergySage, which bullet points out the criteria for homeowners.

Homeowners can use the federal solar tax credit to deduct 30% of the following costs:

- Solar panel costs

- Solar equipment costs, including inverters, wiring, racking mount hardware and other necessary equipment

- Labor costs of installation, including inspection and permitting fees

- Storage batteries for solar energy

- Sales tax paid on solar cost (if you live in a state that has sales tax on solar systems)

Homeowners can download Solar ITC Credit Tax Form (5695) from the Internal Revenue Service website. After filling out the relevant information, homeowners can deduct 30% of solar installation costs.

State Solar Incentives

Chances are your state has at least one solar incentive for homeowners or business owners. Solar incentives are also available in Washington D.C. and U.S. territories — such as Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands and the Northern Mariana Islands.

Many states offer tax credits or rebates for solar expenses. These state tax credit programs only apply to state taxes and the amount varies among states that offer this incentive. Some states offer rebates for expenses associated with solar energy systems, but these may only be available for a limited time while funds are available.

Another form of state-level solar incentives includes Solar Renewable Energy Certificates (SRECs), which may also be called a Solar Renewable Energy Credit. After installation, homeowners can register their solar energy system with appropriate state authorities to track energy production. The state government will offer you SRECs based on the energy generated, at a predetermined rate. Homeowners can sell earned SRECs to their local utility company, but this income is typically taxable.

Local Incentives

Your local city, county or utility company may offer incentives to go solar. This varies location to location, but if you’re going solar it is a good idea to see what’s available in your area. The best resources for this may be your city or county government’s website or contact your local utility company.

Go solar with Enact

Enact offers a comprehensive digital service that coordinates the entire solar installation process from beginning to end, and integrated with top installation partners in every city. Unlike a traditional solar installation company, Enact provides homeowners access to unbiased options for their home. This includes hundreds of different solar panels and other equipment needed to power your home. And then once designed right, allows the best local installer to execute.

Enact works with local solar installers and utility companies to help you go solar. Based on the design you choose, we offer multiple payment options. Our mission is to accelerate the transition to clean energy, and financing options makes it easier. Beyond designing your solar energy set up and coordinating the installation, Enact helps residential and commercial energy consumers monitor their solar energy production, energy usage, storage battery and electric vehicle charging.

Homeowners or businesses can contact Enact’s advisors to start the journey to clean energy. After a short conversation, our advisors can design a solar proposal that will power your home for years to come. The benefit of using Enact is we coordinate the entire process from design to after-installation monitoring. We can design systems that include solar, storage and EV charging — or a combination — that can be monitored through our digital platform.